child tax credit portal update dependents

The Child Tax Credit Update Portal lets you opt out of receiving this years monthly child tax credit payments. The IRS will add more features to the Child Tax Credit Update Portal through the summer and fall.

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

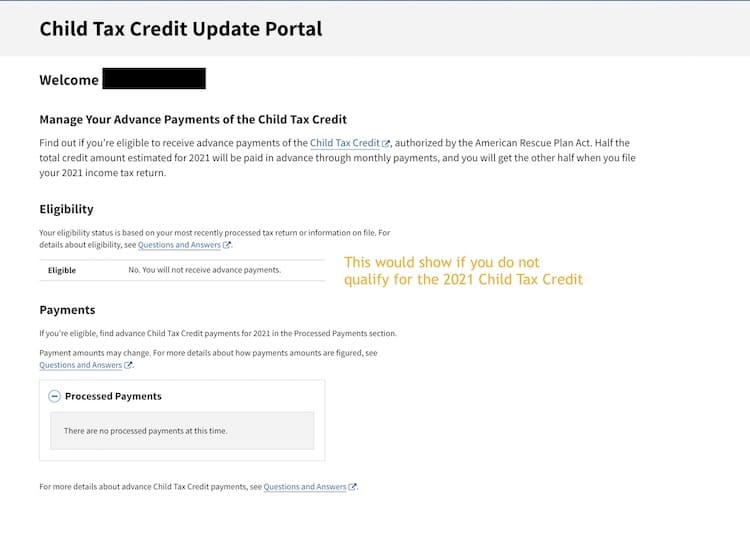

Child Tax Credit Update Portal Learn about advance payments of the Child Tax Credit.

. Or December 31 at 1159 pm if your child was born in the US. Updates that have been made by August 2 nd 2021 will apply to the August 13 th payment. More information is on the Advance Child Tax Credit Payments in 2021 page of IRSgov.

The Child Tax Credit Update Portal enables these families to quickly and easily do that. The advance payments are half of the total so the couple will receive 500 250 per dependent each month until December. Taxpayers can access the Child Tax Credit Update Portal from IRSgov.

Families should enter changes by November 29 so the changes are reflected in the December payment. You can unenroll by contacting the IRS at the phone number on your Advance Child. COVID Tax Tip 2021-167 November 10 2021.

From here you can see if you are eligible for the child tax credit and check on whether you are currently enrolled to receive money or not. Half of the money will come as six monthly payments and. You can access the CTC Update Portal here.

In 2021 then you will receive the child tax credit so long as your income is below 440000 if youre married and filing jointly. 4The individual is properly claimed as the taxpayers dependent. The IRS will pay 3600 per child to parents of young children up to age five.

The IRS recently launched a new feature in its Child Tax Credit Update Portal allowing families receiving monthly advance child tax credit payments to update their income. File a federal return to claim your child tax credit. If you are not you can either still file taxes or use the Non.

The Child Tax Credit Update Portal lets you verify that your family qualifies for the credit and opt out of receiving any payments in 2021. Your advance Child Tax Credit payments were based on the children you claimed for the Child Tax Credit on your 2020 tax return or 2019 tax return if your 2020 tax return had not been processed as of the payment determination date for any of your monthly advance Child Tax Credit payments. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying child.

The only caveat to this is if you and your childs other parent dont live. Once you reach the homepage you will scroll down and click on Manage Advance Payments. The expansion increased the tax credit for child dependents by almost double.

By fall people will be able to use the tool to update changes to family status and income. It also made the parents or guardians of 17-year-old children newly eligible for up to the full 3000. The Child Tax Credit Update Portal has been updated to allow families to update their direct deposit information or to unenroll from receiving advance payments for the child tax credit.

It doesnt matter if they were born on January 1 at 1201 am. You can also use the tool to unenroll from receiving the monthly payments if you prefer to receive a lump sum when you file your tax return next year. In addition families could opt to receive up to half of the payment amount in advance in six monthly payments of up to 300 per qualifying child.

Heres how they help parents with eligible dependents. Enter your information on Schedule 8812 Form. Someone else an ex-spouse or another family member for example qualifies to claim their child or children as dependents in 2021.

That means that instead of receiving monthly payments of say 300 for your 4-year. To reconcile advance payments on your 2021 return. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

5The individual does not file a joint return with the individuals spouse for tax year 2021 or. Get your advance payments total and number of qualifying children in your online account. In 2022 they will file their 2021 return report the amount they received and claim the remaining half of their tax credit 3000.

This tax credit will be available to single Colorado residents earning 75000 or. Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return. Their main home was outside of the United States for more than half of 2021.

Beginning in January 2023 families can claim 5 to 30 of the federal Child Tax Credit for each qualifying child. Throughout 2021 they received 3000 and will claim the other half on their tax return. Simple or complex always free.

June 28 2021 The Child Tax Credit Update Portal allows you to verify your eligibility for the payments. You can also go to the Child Tax Credit Update Portal to see the details of your familys eligibility the total. Soon people will be able update their mailing address.

White House Unveils Updated Child Tax Credit Portal For Eligible Families

Another Child Tax Credit Payment Is Being Sent Today

2021 Child Tax Credit Steps To Take To Receive Or Manage

Why Opting Out Of Monthly Child Tax Credit Payments May Work For Some Families Boyer Ritter Llc

Irs Child Tax Credit Payments Start July 15

Child Tax Credit Update Portal Update Your Income Details Review Your Payments And More Cnet

/cloudfront-us-east-1.images.arcpublishing.com/gray/NTFOD5O45ND3FNB4WAUKZX5ZHE.jpg)

Irs Says Portal Now Open To Update Banking Info For Child Tax Credit Payments

Child Tax Credit Dumb Question R Turbotax

Child Tax Credit Update Portal Update Your Income Details Review Your Payments And More Cnet

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Advance Payments Of The Child Tax Credit I M Definitely Eligible Why Does It Says I M Not R Irs

Dependent Children 2021 Tax Credit Jnba Financial Advisors

How Do I Unenroll Opt Out From The Advance Child Tax Credit Payments Support

Child Tax Credit Dates 2021 Latest August 30 Deadline To Opt Out Of September Payments As Parents Flock To Irs Portal

Child Tax Credit Portal How To Update Your Income Details Before November 29 Marca